|

The National's Video Addressing the rising tide of personal indebtedness in the UAEA panel of experts met for the first time in Abu Dhabi on Sunday to help address the problem of mounting levels of personal debt in the UAE.

The Debt Panel, an initiative of The National, includes a banker, the chief executive of a money comparison website, a wealth and wellness planner and a financial adviser who will, together, address people’s credit-related issues in a weekly column.

0 Comments

Aquarius Magazine "It’s a woman’s world - With international women’s day falling this month, we asked some inspirational ladies for tips from their areas of expertise, to help put some colour into the gaps in your life."

Money coach Rasheda Khatun shares her tips on taking control of your finances, thereby fortifying your future It’s common for we women to leave our partners to deal with the finances. We’ve seen our parents do it, and our friends, and it’s not like we haven’t got enough to do without taking on the finances as well. But we must. Think about this – if you were suddenly left in a position where you were on your own, or without a job, how would you stand financially? Could you afford to take care of yourself? Could you afford to take care of your children? If the answer is ‘no’ to any of these questions, then it’s time to take responsibility for your finances. The proposed budget for your wedding can be one of the most problematical areas once you have said ‘yes’ and begun planning your big day. You and your fiancé or family might have different ideas about how much you are willing to spend on this special occasion, and even if you have already set a budget, disagreements might still ensue once you start making bookings and putting down deposits. It’s amazing how quickly that budget disappears, and how tempting it is to ignore this financial limitation!

Thankfully, our BCME expert panel member and wealth and wellness coach, Rasheda Khatun Khan at www.rashedakhatun.com, has some fantastic advice to help you both stick to your budget. If you’re beginning to get frustrated or are experiencing disagreements with your partner about the budget for your wedding day, have a read below and take on board Rasheda’s recommendations. Flowers, jewellery and surprises are all wonderful ways of expressing how much you love your partner and as a women, I can say they are greatly appreciated. Though it is always in times of distress that we can truly see what it takes to love. How one rises when they fall, overcomes their fears and still does what it takes to take care of their family, no matter what, now that is love! People buy life insurance because they love someone and to protect them financially. The question to ask is how will my family manage financially when I die? It’s a subject nobody really wants to think about, but if someone depends on you financially, it’s one you can’t avoid.

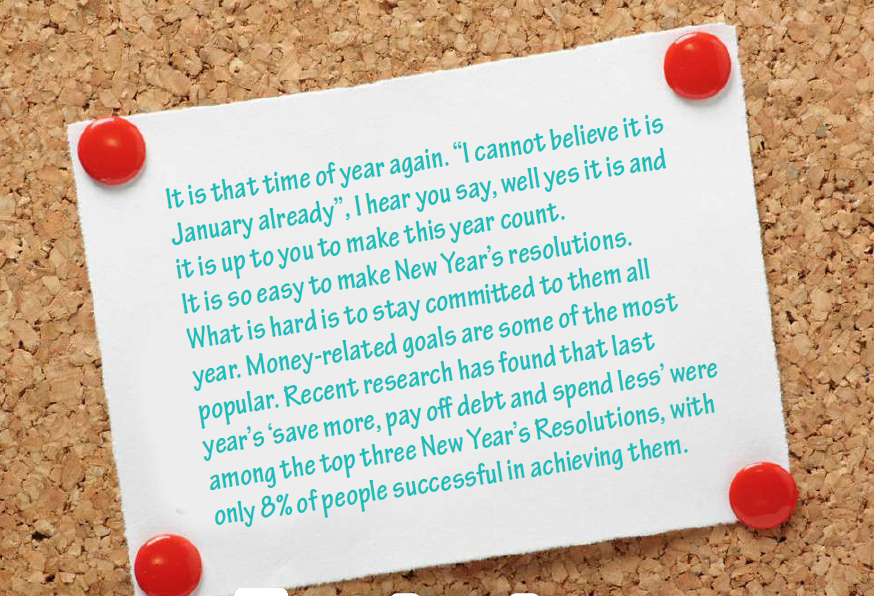

So why is it that we just cannot stick to our money resolutions? Why can we not keep that promise we make to ourselves?

The answer is – we do not make a strong enough commitment. Making an agreement with yourself is just so easy to break because you only have yourself to answer to and we are all good at cutting ourselves a little slack. A good agreement is made up of a worthwhile outcome and a penalty clause if you break it midway. The strong commitment comes from the level of importance of the outcome to your life and what holds you to it is the penalty clause or pain if you let yourself down. Here are 5 steps to make sure you make a big difference to your pocket in 2016. Almost every bride-to-be will admit it; in the run up to her wedding day, it can be hard to envisage married life beyond the stunning gown, the beautiful flowers and the excitement of friends and family. Indeed, most couples will become so consumed by the big day itself that the ‘after’ in ‘happily ever after’ is temporarily forgotten in the midst of decision making, planning and general ‘wedmin’. Moreover, sitting down as a couple to talk about your soon to be joint finances can seem unglamorous at best, and at worst, a daunting prospect.

Ahh, tis the season! Well, actually, it’s the season after The Season.

January is that troublesome time of year after we’ve eaten too much, spent too much, indulged too much and certainly slept too little. It’s a wistful time when we reflect back on our recent past and gaze forward to our immediate future. Traditionally, it’s a time when we make solemn promises to ourselves in the form of New Year’s Resolutions. When you read this, there will only be 20, or maybe its 15, no make that 5, shopping days until Christmas. The truth is that for most of us time is going by at F1 speed and accelerates to warp speed during the holidays. In a blink, Christmas is over and many of the kids’ gifts are already broken. What’s a parent to do?

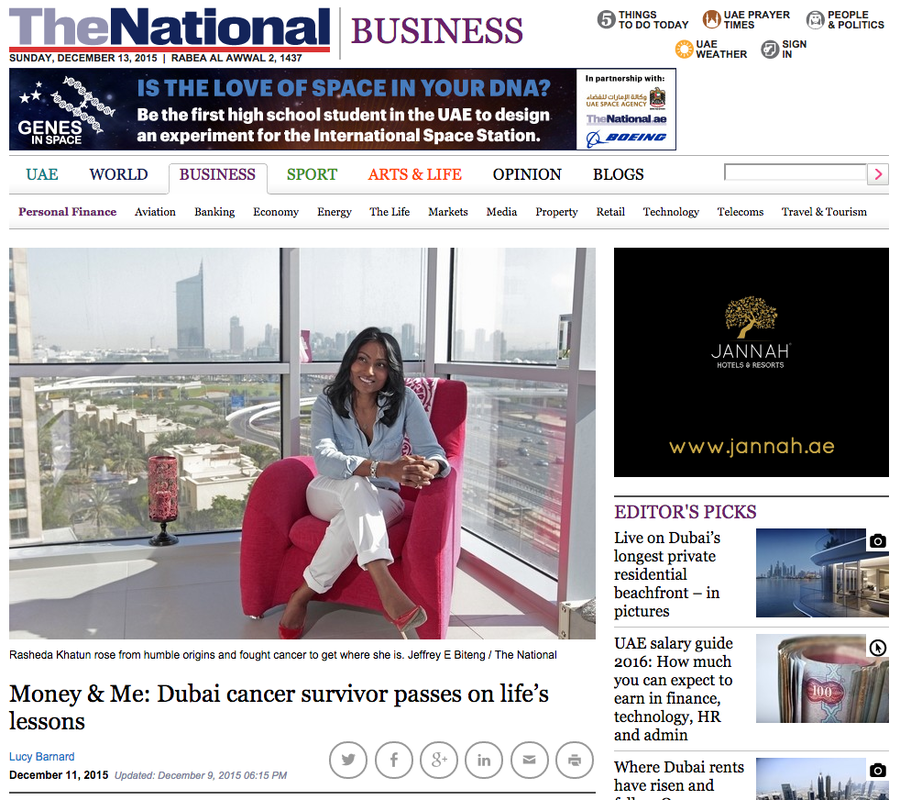

Rasheda Khatun Khan is an independent wealth and wellness planner. Born in the UK and living in Dubai since 2005, the 34-year-old started her career as a financial adviser in corporate banking. In 2006, she was diagnosed with Hodgkin’s Lymphoma and was told her chances of survival were slim. After intensive treatment, she made a full recovery and now teaches others the life lessons she gained from beating cancer through her work as a speaker, financial adviser and leadership and personal development coach.

|

Archives

September 2019

Categories

All

|

RSS Feed

RSS Feed