|

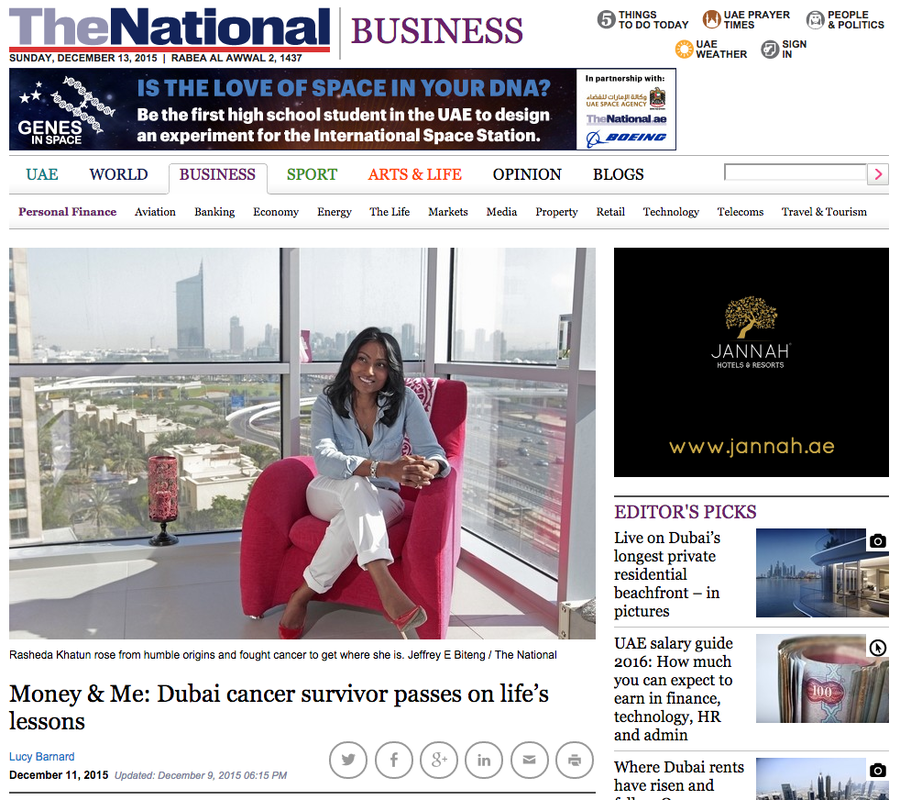

Rasheda Khatun Khan is an independent wealth and wellness planner. Born in the UK and living in Dubai since 2005, the 34-year-old started her career as a financial adviser in corporate banking. In 2006, she was diagnosed with Hodgkin’s Lymphoma and was told her chances of survival were slim. After intensive treatment, she made a full recovery and now teaches others the life lessons she gained from beating cancer through her work as a speaker, financial adviser and leadership and personal development coach. How did your upbringing shape your attitude towards money? When I was growing up, I didn’t ever believe I could be wealthy. I didn’t think it was at all possible. Around me were stories of struggle. There were big families with not enough household income. They were working two or three jobs just to survive. They were unable to say “yes” to big lifestyle choices, like having a house big enough to live in comfortably, being able to put kids in the schools they preferred or being able spend time with family and friends because of travel costs or the time demands of work. I’d seen and heard it all. So I decided to work as hard as I could and get as far as I could, thinking that if I could just survive and have a few luxuries, I would have made it. I grew up believing that wealth only came to those who were born in rich families or won the lottery. Today I know that anyone can decide to be wealthy themselves and make it a reality. How much did you get paid for your first job? In my first proper job. I earned £500 (Dh2,766) per month. I went from an office clerk, or tea lady, to now working for myself helping people raise the quality of their lives by enriching their financial mindset. Are you spender or a saver? Both. Planning for the future is so important and embracing today is too. The balance is the healthier choice. What is your most cherished purchase? It was actually my first “ridiculous” buy – a Porsche Carrera 911. This was a very significant moment in my life and shaped my new beliefs around money too. I was always money-conscious and would spend carefully. After my near-death encounter I realised the importance of balancing life. I realised I had always lived in the future and not in the present. I had always had goals and gone for them and as soon as reaching them I would set another goal. I realised I really celebrated my life and the things I’d achieved and enjoyed. So I bought a Porsche to celebrate the fact that I’m alive and healthy. It’s my most dreamed about car. I love it. Have you ever had a month where you feared you could not pay the bills? A few times. It creates so much anxiety and fear and actually makes me feel ill. Where do you save your money? In many places: in cash at home, in cash in a bank, in longer-term investments by saving monthly and automating it and in property. Do you prefer paying by credit card or in cash? It depends on the transaction. I use a credit card to gain points and benefits and to give me a month’s grace. But I always pay off my credit card balance in full so that I don’t incur charges or have to pay interest; I don’t build up debt I can’t pay back. My repayment is also automatically taken at the end of the month. What do you most regret spending money on? No regrets. Yes I’ve spent unnecessarily and on random things I don’t need such as clothes and shoes I never wore, but no really big purchases. I’ve made some wrong investments, too, in property but they have all got me to the next level. And any clothes I don’t need I give away to charity. What financial advice would you offer your younger self? Save every month and lock it away. Even when you can’t “afford” to save, put something away even if it is just $20 that month. And take out life insurance early.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

September 2019

Categories

All

|

RSS Feed

RSS Feed